I provided a rather winded explanation in my previous discussion about why the current correction was inevitable. Since then, the S&P 500 has declined roughly 3%. It is likely to get worse before it gets better? My own estimation was a 8% to 10% correction which would see the S&P 500 fall below the 1700 mark. Of course a bout of strong earnings (or rising expected earnings) might dampen the damage but we won’t have that information for a few months.

I provided a rather winded explanation in my previous discussion about why the current correction was inevitable. Since then, the S&P 500 has declined roughly 3%. It is likely to get worse before it gets better? My own estimation was a 8% to 10% correction which would see the S&P 500 fall below the 1700 mark. Of course a bout of strong earnings (or rising expected earnings) might dampen the damage but we won’t have that information for a few months.

In order to fuel a comeback (which I also expect) we need two things to happen:

1. We need to get through the uncertainty associated with tapering and the debt ceiling…yet again.

From CNN Money Jan. 16, 2014: “Treasury Secretary Jack Lew called on Congress Thursday to move soon to raise the nation’s debt ceiling to ward off any risk of a U.S. default, saying the crunch will come by the end of next month.”

2. Global markets need a new stimulant to offset the effects of rising interest rates. In my experience the impetus to strong economic growth (and rising markets) comes from the least expected source.

A substantial decline in energy prices in my opinion just might provide the impetus needed. Surprised?

Consider how insane things became just a few years ago. I found the following – text and chart from 2007 – buried in Federal Reserve Bank of San Francisco publications:

(2007) Why are oil prices rising?

“Global demand for oil has been increasing, outpacing any gains in oil production and excess capacity. A large reason is that developing nations, especially China and India, have been growing rapidly. These economies have become increasingly industrialized and urbanized, which has contributed to an increase in the world demand for oil. In addition, in recent years fears of supply disruptions have been spurred by turmoil in oil-producing countries such as Nigeria, Venezuela, Iraq, and Iran.”

That was a bubble long forgotten. The economies of China and India have slowed, and the U.S. is trending towards energy self-sufficiency thanks to production growth nobody envisioned back then. The question today is why oil prices haven’t fallen further? The current price certainly can’t be explained by inflation. Picking a random starting point, say 1994 – inflation should imply a current price of crude about 124.2% higher today. But since the price of oil in 1994 was $14 that would mean today’s price should be $32.

Also, the U.S. remains (as of 2012) the largest consumer of world oil at 18.5%, with China having closed in to 10.3% according to the U.S. Energy Information Administration.  When the oil price rocketed up a few years back, it might have been simply because demand had outstripped supply. As the chart I whipped up (using EIA data) illustrates, there was indeed a sudden deficit in 2006 and 2007, in contrast to the surplus years of the mid to later 1990’s.

When the oil price rocketed up a few years back, it might have been simply because demand had outstripped supply. As the chart I whipped up (using EIA data) illustrates, there was indeed a sudden deficit in 2006 and 2007, in contrast to the surplus years of the mid to later 1990’s.

But what scenario is developing today? With lacklustre economic growth elsewhere on the planet, not to mention ongoing energy-saving developments, this rapid growth in U.S. oil production might create a few years of surplus oil.  This would be bad news for the energy sector whose costs of production have increased over the years, but would be a welcome shot in the arm for global productivity and industrial profitability.

This would be bad news for the energy sector whose costs of production have increased over the years, but would be a welcome shot in the arm for global productivity and industrial profitability.

If I am right, then earnings estimates for the latter half of 2014 (most I’ve seen expect a modest increase of around 8%) are understated. Sectors sensitive to energy costs (certainly NOT the recent darlings like technology and health care) stand to benefit the most. Commodity producers for example might get the best of both worlds – higher commodity prices due to stronger demand but lower overall costs thanks to soft energy pricing.

But what about the “January” effect? This quote is from CNBC:

“The January barometer has been right in 62 of the last 85 years, or 73 percent of the time. Since 1929, the index followed January’s direction 80 percent of the time when it finished positive, and 60 percent of the time, when it finished negative.” (Published: Friday, 31 Jan 2014)

As a lifelong student of investment and finance theory (and now a professor) the only thing I can definitively conclude is that statistics tell us zip. In 2003 the market lost nearly -3% in January, but ended the year UP 50%. Finding potential (and rewarding) exceptions to the rule is what investment research is all about. THIS JUST IN:

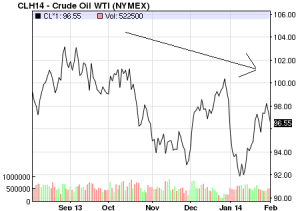

Bloomberg: by Mark Shenk Feb 3, 2014 1:51 PM ET

West Texas Intermediate crude fell for a second day after manufacturing gauges in China and the U.S. declined, signaling reduced fuel demand.

Futures decreased as much as 1.3 percent. The Institute for Supply Management’s U.S. factory index dropped more than forecast last month. China’s Purchasing Managers’ Index slipped to a six-month low in January, a sign that government efforts to rein in credit will cool growth in the biggest oil-consuming country after the U.S. WTI’s discount to Brent shrank to the narrowest level since October today.

Unless there’s a meaningful disruption in oil supply or increased hostilities in the Middle East, the trend in oil prices should continue down. Of course, conspiracy theorists might argue that turmoil in places like Iraq, Syria and Iran are orchestrated by Saudi Arabia, oil companies and the U.S. government in order to keep oil prices way higher than they should be. High prices certainly help OPEC’s finances and make U.S. domestic production economic.

Unless there’s a meaningful disruption in oil supply or increased hostilities in the Middle East, the trend in oil prices should continue down. Of course, conspiracy theorists might argue that turmoil in places like Iraq, Syria and Iran are orchestrated by Saudi Arabia, oil companies and the U.S. government in order to keep oil prices way higher than they should be. High prices certainly help OPEC’s finances and make U.S. domestic production economic.

But prices can resist supply and demand dynamics only so long. Will we see $30 oil? Not very likely but $80 crude or better will provide enough fuel to bump corporate profitability. Don’t be surprised to find S&P 500 earnings up 20% this year, and the index approaching the 2000 level BUT ‘after’ this correction is done – which is what I proposed in my previous commentary.

Whenever I think about U.S. domestic oil production, this (below) comes to mind…..can’t help it!